Master FCA Capital Adequacy and PS Complaints Returns in 5 Simple Steps

Payment companies, your financial year-end is a busy time. And while your finance team is likely helping with financial reporting, FCA reporting is often left until the last minute.

This is a risky approach, as the FCA emphasized in their March 2023 Dear CEO Letter that regulatory reporting is a priority for 2023 and that they’ll take action against those that don’t meet standards, including fines and enforcement action.

To help you avoid any missteps, we’ve compiled a simple 5-step checklist to help you prepare for your FCA Capital Adequacy and PS Complaints Returns.

1. Check You Don’t Have an Accounting Reference Date Mismatch.

Check you don’t have an accounting reference date (ARD) mismatch. This means that the period of your company’s financial statements and the date recorded with the FCA differ.

Check for a mismatch by comparing the date on the financials you submit to Companies House vs the date held by the FCA in their RegData platform.

This is simple, yet so many companies get it wrong which results in misreporting to the FCA!

To fix a potential mismatch, you’ll need to complete section 6 of the form Notification to Amend Firm Details and submit it to the FCA online.

Need help changing your ARD? Send me an email [email protected] and we’ll do it for FREE, no strings attached.

2. Make Your Finance Team Aware of The Deadline for Your Capital Adequacy Return

It’s important to let your finance professional know you’ll need your company’s annual financial statements prepared in advance of your Capital Adequacy Return deadline.

Accountants and Finance Teams can be a bottleneck when it comes to regulatory reporting. The statutory deadlines they work to are much longer than the deadlines set by the FCA. This creates a risk that they won’t have your financials ready on time for your Return.

To avoid this, let them know well ahead of time – ideally months before the deadline – so your financials are ready in good time.

To streamline the process, we recommend using cloud accounting software like Xero, QuickBooks or Sage. This will make preparing financials a breeze. Plus, you can integrate your cloud accounting software with an automated reporting solution like ComplyFirst to automate your Capital Adequacy Return too. Win-win.

3. Remember, FCA Reports are Concerned with Your Payment Services Activity.

When FCA reports ask you for data this is in relation to your company’s Payment Services Activity only (unless otherwise stated).

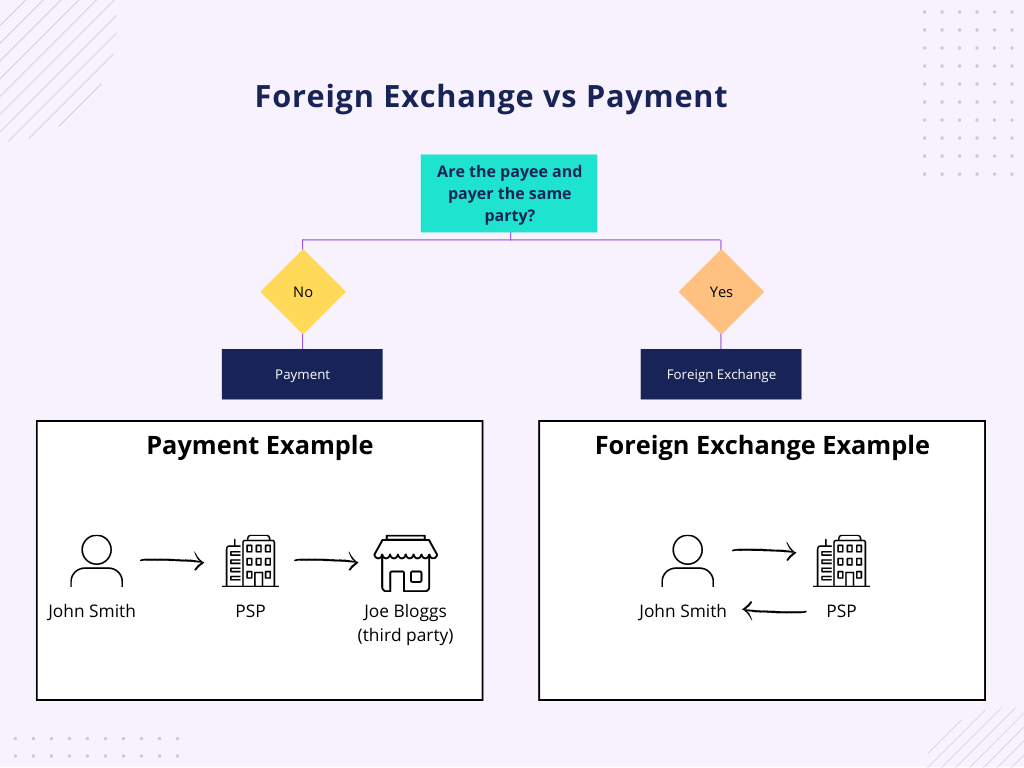

This means if your company provides foreign exchange (an unregulated activity) and payment services (a regulated activity under the Payment Service Regulations 2017), you should split these and just report your payment services activity. The FCA has provided guidance on what constitutes FX activity vs Payment Service activity here.

Here’s what the difference looks like in practice:

Good to know, right?

4. Get Your Customer Complaints Data Ready.

Start collecting your complaints data right away. Payment firms tend to store complaints data in a variety of mediums including email, Excel, or paper files, and this can take time to sift through.

For your PS Complaints Return, you should report data related to the Payment Services you provide and include the following detail:

- Dates the complaint was opened and closed.

- Payment Service which the complaint relates to.

- Value of any redress paid to the customer.

5. Assign Tasks to Your Team-members Now.

You’ll probably spend more time than you imagined collecting data and preparing your reports. This puts you and your team under unnecessary Pressure with a capital “P”.

My advice is to put a plan in place today.

- Let your finance team know when you’ll need the financial statements;

- Tell customer support when you’ll need your complaints data;

- Give compliance and executive teams a heads-up on when you’ll need their sign off.

How can ComplyFirst help?

ComplyFirst provides an automated reporting platform to help you get your FCA reports done quicker and more accurately with less effort.

We collect regulatory data from your business systems, apply the FCA’s regulatory logic then validate and upload your reports in the required format to the FCA RegData platform.

Plus, we provide some amazing value-add tools for your team to log customer complaints and collaborate on reports with other team members. Using these tools means you can say goodbye to manually compiling complaints data and playing email ping-pong with your teammates when reports are due. You’re welcome.

Godspeed with your FCA reporting!

-Fiona

Regulatory reports giving you a headache? Don’t worry, we’ve got the cure! Book a FREE 30-minute reporting Q&A session with our Founder and resident reporting guru, Fiona Jelly. With 12 years + of experience in compliance working with some of the best-known brands in finance, she knows regulatory reporting like the back of her hand. So, if you’ve got questions or just need some friendly advice, hit the button below.

Limited to 5 places per month!