5 top tips for successful FCA authorisation for fintech start-ups

With limited time, a tight budget and lots of other responsibilities, how in the world will you navigate the FCA’s increasingly complex authorisation process? But you must!

However, the stark reality is that in 2022, the FCA authorised 20 Payment and e-Money firms compared with 71 firms in 2021. A major factor is the FCA’s increasingly exacting approach at the authorisations gateway. The FCA acknowledged that the “increased scrutiny we apply at the gateway” is a factor increasing the number of firms not authorised in 2021/22 to 1 in 5, up from 1 in 14 the previous year.

So, it makes sense to take a structured approach to preparing your application. Time spent doing the groundwork before you submit is time saved by not having to redo it.

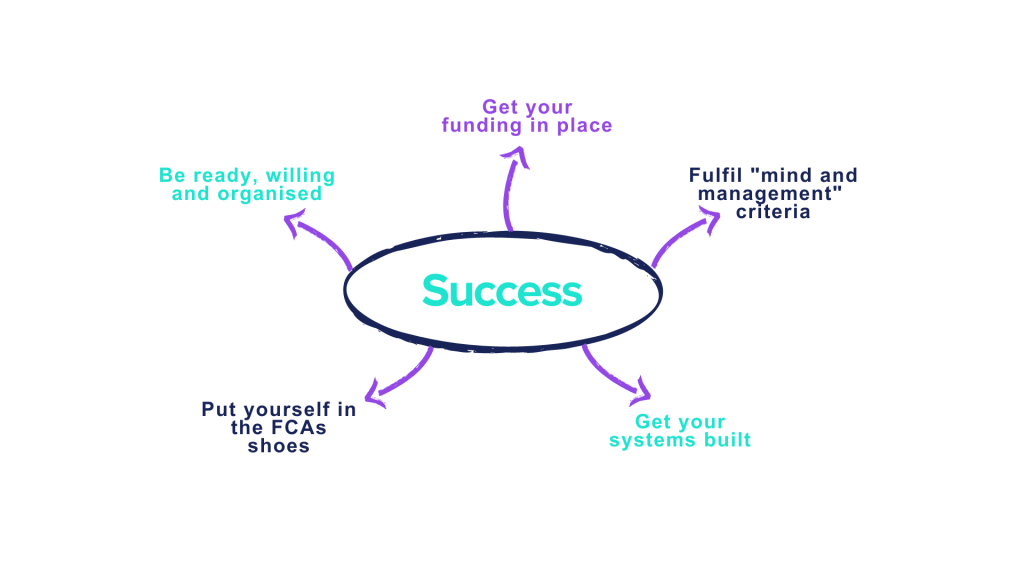

For the best chance of success, follow our 5 top tips for successful FCA authorisation for fintech start-ups.

1. Demonstrate that you’re ready, willing, and organised.

Having a solid regulatory business plan in place is essential to demonstrate to the FCA that you’re ready, willing, and organised to deal with anything that life throws at your business.

Putting together an effective business plan requires intense focus on key areas of your business. Firstly, who is your target audience? Will you service corporates, consumers, or both? Which channels will you use to deliver your fintech offering? Then document why your proposed business will be successful. What’s your USP? How will you achieve revenue accretion to ensure your business is sustainable?

Concentrate on the following five key areas and ask yourself:

- Capitalisation: How much money do we need to satisfy the FCA’s capital resource requirements? How do we evidence this with financial information in our application? What steps do we need to take to ensure that we’re a revenue-accretive and sustainable business?

- Governance: Who are the firm’s key individuals, and what management responsibilities will they have? Do we have the right mix of experience and expertise to oversee a regulated business?

- Business model: What activities (both regulated and non-regulated) will we provide to customers? Will we work with lead generators or brokers? Will we need to hold any client money?

- Customers: How do we ensure that fair treatment of customers is at the heart of our business model? What processes do we need to put in place to ensure we service customers correctly from acquisition through to after-sales care?

- Compliance: How do we put the right compliance structure in place? How do we approach risk-based compliance? Do we use a third party to assist us? And how do we ensure quality assurance on an ongoing basis?

The answers to these questions will provide a solid basis on which to build a compelling business plan.

2. Get your funding in place, upfront.

Getting funding in place should be obvious, but the devil is in the detail. You’ll need to ensure that the money is sitting in your business bank account before you apply for authorisation and that it’s sufficient to cover your initial set-up costs, salary costs and FCA application costs. At the same time, you need to be able to demonstrate capital adequacy at the time of your authorisation and on an ongoing basis.

All this needs to be clearly set out in your authorisation application and you must provide financial projections. Forget back-of-the-napkin calculations. You’ll need to prepare detailed financial projections for (at least) the first 12 months. Spreadsheets at the ready!

3. Demonstrate that you fulfil the regulator’s “mind and management” criteria.

There’s no doubt that your team will be critical to the success of your business, but did you know they’re also critical to the success of your FCA authorisation?

In your application, you’ll need to demonstrate that you meet the FCA’s “mind and management” criteria, and this requires you to get your human resources in order. Positions such as CEO, CFO, Head of Compliance and MLRO will need to be filled or, at the very least, appointments made at the time you submit your application. This is critical to meeting the FCA’s threshold conditions for authorisation.

But it can be tough to find the talent and expertise you need for your fledgling fintech, and it takes time to find and engage at an individual level with each hire. So how do you build your fintech’s management team?

The answer is to look within your network and groups of people matching your target hires. Spend time researching this. Where do they work? Where do they hang out online and in person? Do you need to build relationships with specialised recruitment agencies to get access to top talent?

Naturally, building out a stellar management team and having these hires in place before you apply for your authorisation could cost you dearly. Don’t forget to factor this into your fintech’s funding requirements.

4. Get your systems built.

It goes without saying that the FCA won’t entertain an application based on what you intend to build. So, either buy or build your systems now.

You’ll need to consider what technology you need to process transactions, onboard new customers, and what tools you’ll use to ensure you submit regulatory reports to the FCA in an accurate and timely manner. Keep in mind that as part of the authorisation process, the FCA will ask how you plan to fulfil your compliance obligations, especially your regulatory reporting, so start thinking about that now.

To help bolster your application for authorisation, you might consider partnering with a RegTech company that offers the service you need. For instance, ComplyFirst provides an automated regulatory reporting service to ensure reporting compliance. Not only will your RegTech partner help you achieve FCA authorisation initially, but they’ll help you stay that way.

At this point, you may be thinking “should I build some custom software in-house or buy an off-the-shelf solution? One of the key questions you should ask yourself is whether the technology will provide you with a competitive advantage relative to your competitors. If there’s no competitive benefit in building bespoke software, then buying the technology is the way to go. Whereas if there’s some comparative advantage, and it could be truly transformational for your customers and your business, then this is something your business should look to build in-house.

Nowadays it’s industry practice that your transaction systems, know-your-customer (KYC) tools and regulatory reporting technology are bought, not built. Let the RegTech experts handle that for you, so you can get on with growing your business.

5. Put yourself in the FCA’s shoes.

The final thing you need to do before you press “submit” on your application is to put yourself in the regulator’s shoes. Ask yourself: “Do I meet the threshold conditions for authorisation, and have I provided evidence of it?”

Dot all the i’s and cross all the t’s. Once you’re happy, hit “submit” and enjoy crossing that task off your (probably very long) to-do list.

Get the FCA authorisation you need to grow your fintech! Let our founder, Fiona Jelly, guide you through the authorisation process including the importance of FCA Regulatory Reporting. Book your FREE 30-minute Zoom call today.